Volume Two

Modern States

The Future of Money

Present Picture

We have seen how money arose in the Mesopotamia city states as a debt or obligation owed by individuals to the community. Inescapably, money became part of the fabric of social life, which it therefore tokenised and partly controlled. Coinage arose much later, widespread with the growth of centralised states needing taxes to pay for large mercenary armies, but also vital for trade. Gradually, as feudal states gave way to mercantile societies and these to commercial empires, financial institutions became laws unto themselves, today exceeding in power even the largest of western democracies.

Yet what money actually is, and how that power is justified, rests on nebulous arguments, most of them tacitly accepted rather than properly established or understood. Some indeed are demonstrably false, like market economics, or promote the interests of small sectors over the needs of industry, commerce and the community at large, as do share buy-backs, quantitative easing and bank bailouts. Marx based his theories on ethics, on the needs of prosperous and equitable societies, but communism has been roundly trounced by capitalism, which holds undisputed sway over governments that nonetheless face mounting problems over distribution of the earth's resources.

But is this a true picture? Did hunter-gatherers inevitably give way to agricultural societies, with armies needed to protect the fruits of labour from outside marauders? Does civilisation necessarily mean wars, taxes, bureaucracy, patriarchy, and even slavery if we are also to have literature, science, philosophy and the other great human achievements? That conventional picture has been challenged by Graeber and others, {1} who argue from archaeological and anthropological evidence that early societies were not simple hunter-gatherers, that agriculture did not mark an irreversible break with the past and that the first cities were often robustly egalitarian. We are, in fact, projecting the everyday assumptions of our capitalist world onto the past rather than reading the historical record objectively. Societies drifted in and out of agriculture, came together in vast festivals, set up authoritarian societies and then dissolved them, buried their dead simply and with astonishingly rich grave goods. In short, inequality is not a product of civilisation, and wealth did not always lead to power.

Moral Dilemmas

To most observers, there are no moral dilemmas. Economics is a science, a discipline that outlaws moral concerns beyond a simple obligation to allocate scarce resources appropriately. Mainstream writers emphasize the obvious, {2} that little of our contemporary world would have been possible without equally powerful banking services, and that, if problems were high-lighted by the 2008 financial crash, banking is only a mirror that displays our common human failings. {3}

But banking is not simply a mirror, but often appears an abstruse conjuring trick solemnly performed by otherwise model citizens — industrious, well-educated, liberal-minded and often as cultivated as were the Medici of Florence. {4} Banking in England was a gentleman's profession, and the bankers who advised the disastrous return to the gold standard after W.W.I were doubtless acting in good faith. {5} Acting in a comparable fashion today are Wall Street bankers, who must often turn down investment in the developing world because there are minimum criteria to follow: ignoring the required ROI only brings grief. {6} But, as David Graebar noted, the results are often bizarre. {7} Hernán Cortés behaved outrageously towards Mexican native populations and to his own men because he was indebted to Genoese bankers. The third world debt burden has increased, although repayments now amount to several times the original loans. {8} The first trading companies employed an early form of banking — the joint-stock company — to trade in arms, slaves and drugs (spices, tea, coffee and sugar), and today the same items make an appreciable part of bank profits (armaments, human trafficking and drugs). {9} Most of these practices, so clearly injurious to the world at large, would disappear if banks applied due diligence. But banking is a fraternity of self-interest, and would see giving up lucrative practices as a treason to its shareholders. Small business and home-owners were not bailed out in the last melt-down, and another crash may well see 'bail-ins', i.e. depositors' assets seized. {10} Money still breeds a socially irresponsible attitude. 'You only need to make your fortune once' is the motto, and the greatest risk-takers are the best rewarded. {11} Both vulture capital and hedge funds so perilous to currency stability draw their resources from banks. {12}

As must be evident, 'the financial system serves the wrong policy. Instead of facilitating to the greatest possible extent the efficient delivery of those goods and services that people can use with profit to themselves, the conventional financial system centralizes wealth, power, and privilege in the hands of those who have acquired monopoly control over financial credit.' Banking has become as inefficient as the tax collection in pre-modern Europe, where revenues needed by government were siphoned off to private coffers. Nothing banks do today could not be done by government institutions under public scrutiny. Indeed the Neoliberal economic model, in which international finance features so strongly, is becoming untenable. The drain on natural resources, already threatening, would increase twenty-fold if everyone enjoyed the life style of the west. {13-16}

But there are larger issues that anthropologists, historians and economy-minded sociologists probe by asking such questions as: What is debt exactly? How can personal obligations be measured in abstract money terms? How did whole nations become ensnared in western banking practices? What is the rationale behind growing inequalities in countries and classes that economics claims result from pure market forces, when those market forces include a good deal of political control, economic coercion and the threat of military action? Eight questions are worth asking: {17}

1. Modern banking began with the Bank of England, a private business loan to the king. But what started as simple promissory notes have become — with the worldwide expansion of banking services and universal suffrage — a debt that everyone owes to banks, which do only a little paperwork to earn that power and wealth, the more so now that risks are borne by tax payers. {18}

2. How do banks act as bridges of respectability between areas of collective madness: the tulip mania of 1637, {19} the South Sea Company of 1720 and the Banque Royal of 1721? {20} Like coinage, banking seems to give an aura of legitimacy to dubious activities, often beyond the control of electorates. {21}

3. How has a network of moral obligations that citizens owe each other in any functioning society turned into an arm's-length, impersonal and abstract system of self-interest? Banking has no allegiance or loyalty to anything but itself: its returns, commissions and business reputation. Is that a proper foundation for any state, and not rather the root cause of increasing cynicism in politics and public affairs? {22}

4. Is the freedom of capitalism any more than autonomy in consumer choice, especially when some 50% of those living in former communist countries would apparently prefer to go back to the previous cradle-to-grave welfare system? Does it not merely oblige each citizen to fend for himself, where, far from being free — not with careers to train for and navigate through the politics and downsizing in the workplace, a family to bring up, insure for sickness and old age — it simply relieves the state of these complex and troublesome tasks? Very strong cases have been made for the liberating powers of capitalism, but they have acted within state control, and hardly apply to rural areas of India where market forces divorced from social responsibility have driven hundreds of thousands to ruin and suicide. Even in western economies, the unrelenting drive for profit brings a host of problems. {23}

5. The capitalist view of enterprise is suspect. The reward for abstinence — the classic argument for interest earned on capital — also applies to employees: they turn up for work rather than take a holiday. Entrepreneurs may lose their money, but employees risk their skills and health. Holding shares in a company cannot be really entail owning its land, plant, labour and capital, but only the right to share in its profits, to vote at general meetings and to have a share of remaining assets when a company is wound up.

6. Are not societies becoming over-complicated, a recipe for past civilisation breakdown? {24} Banks are surely growing larger and more complexly interlinked in a way no engineer would allow. Engines need decoupling clutches, and forestry plantations build firebreaks for the same reason. Time-dependent situations, where the situation today depends on its previous situation — unavoidable in currency operations — are inherently unpredictable. {25}

7. Many of these issues arise because of reification, of supposing that abstractions, processes and social engagements are concrete entities remaining real and unchanged across all possible worlds. Marxist labour theory is a case in point. How can labour, plant, land and investment be equated? demand contemporary western economists. But Marx asked the more imperative question: how could such desperate poverty arise in a God-fearing and supposedly free country? The bourgeoisie were no cleverer than the proletariat, no more human, responsible or supportive of others, nor worked harder. Why should the accident of birth give leisure to a few and misery to the rest? Social justice required that people benefit fairly from their efforts.

But Britain was not an egalitarian society, and had never claimed to be. Only a small percentage had the vote. If the bourgeoisie were better off, they were also better connected and better educated, just as a class-segregated society should be. Economics can never be divorced from politics, since both involve power. Truly classless societies are hard to achieve, moreover, and bring their own productivity problems. With the benefit of hindsight, we know that communist societies have indeed not been a success, but must also accept that the tyrannies needed to overthrow the old order were kept in place to control the new — indeed had to be when other institutions and social structures were swept away by war and civil strife. The old regimes in Russia and China were too rigid to cope with needed social change, or at least yielded too slowly. The time scale is always important. Illiterate farmers became university professors in secularised Iraq and Afghanistan, but the process took several generations. Men do not readily give up their traditional ways of life because those ways give purpose, status and significance to their lives.

8. Banking turns human beings into numbers, and, however sophisticated may be the way those numbers are handled, they remain dependent on what was first selected, and how. For all its claims, economics is not a science, not derived by measurement and observation, but model building supported by selected evidence. But even in physics, one of the 'hard sciences', relativity theory reminds us that nature presents herself as an organic whole, with space, matter and time commingled. Humans have in the past analysed nature, selected certain properties as the most important, forgotten that they were abstracted aspects of a whole, and regarded them thereafter as distinct entities. They were then surprised to find that they must reunite these supposed separate concepts to obtain a consistent, satisfactory synthesis of knowledge. Likewise, new concepts like quantitative easing, bank bail-outs, irremediable national debts and modern money theory cause us to re-examine what money really means. {26}

What's In A Word?

Much confusion arises from using the same word for only broadly similar functions. Personal debts are in no way like government debts. If, for example, someone makes a loan to a friend for old time's sake, and so generously that the lender's own lifestyle is seriously endangered, then most of us would expect the loan to be repaid on time. But if a bank makes the loan, and takes the house or business as collateral, is the moral injunction to repay so strong? After all, the bank does not lend its own or anyone else's money. It simply makes a digital transfer. Governments don't have to balance the books in the way of the ordinary company or householder, moreover, and creating a budget surplus, which is often lauded as desirable by politicians and public officials, in fact takes money out of the system, i.e. is deflationary and generally harmful to the public good.

Individual debts have to be paid off with money individually earned, in competition with others. Government debts do not have to be paid off, by taxes or anything else, but can be settled digitally with a few keystrokes. Government projects can always afford their expenditures as they are not limited by funds but by labour, resources and technical know-how. {27}

Expenditures are also controlled by attitudes to work and our fellow human beings. The Athenians could well have built their navy to counter the growing Persian threat by imposing corvée labour on their citizens. Instead, they employed the silver from the new find in the Laurion mines, which enabled everyone (except the wretches employed as miners) to prosper while serving a public purpose. Money turned an individual's need for economic gain into the state's survival.

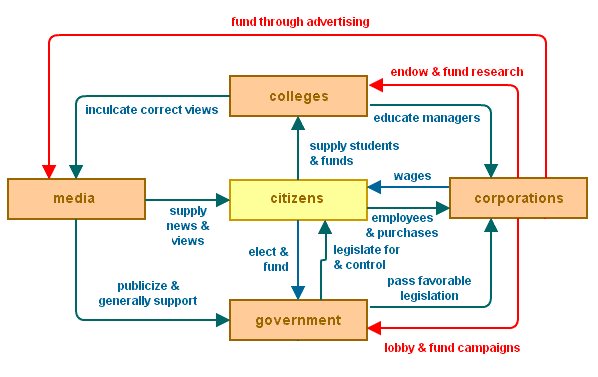

Money as a term has various meanings, many of them shadowy and vaguely bound up with tacit beliefs, values and the working methods of institutions that constitute a functioning state. Economics claims to be a science, to model things that exist 'out there', independent of our senses and human values. Neoliberal economics is based on the market, where rational human beings act with enlightened self-interest. Unhappily, human beings are not rational, and marketing, which now holds sway in most areas of life, from choice of washing powder to US presidents, is precisely intended to make our choices non-rational and ill-informed, even against our best interests at times. Public opinion is overtly managed by mainstream media owned by a few corporations only. Nor are markets substantially free in the sense that participants fully understand the wisdom and consequences of their choices. Indeed no one could, even in a world free of advertising and misrepresentation. Life is simply too complex to be fully grasped, and the situation is made even more unfathomable by time-dependent feedbacks, which inevitably give rise to complex systems and so render the simple nineteenth century models employed by economists, government planners and politicians haplessly ineffective.

Inherent in words are many expectations and histories of usage. Meanings of scientific words are generally defined by the relevant institutions, as are meanings in accountancy, and in the trades and professions generally. Meanings in the humanities, however, or even in everyday use, are far more protean and elusive. Literary theory has to use special concepts to map out what is probably being meant or understood by a text. {28-29} Hermeneutics, for example, examines the social, cultural and historical aspects of context, and how we interpret a text from our own current perspective. Such a procedure, which we follow in bridging social usages, takes into account not only abstract meaning, but an individual's experiences, affections, character, social and historical setting. Hans-Georg Gadamer {28} takes issue with the prevailing Enlightenment view that man would live happily and at peace if old prejudices and superstitions were swept away. Inevitably, if only in part, we live on our historical inheritance, in a dialogue between the old traditions and present needs. And there is no simple way to assess that inheritance except by trial and error: praxis: living out its precepts and their possible re-shapings. Rationality of the scientific or propositional kind is something we should be wary of. It evades what is seen by Gadamer as important: our direct apperception of reality, the 'truth that finds us'. But if the flow of existence is a continuing disclosure of meanings, how are we to recognize these meanings and know they are correct? Gadamer asks us to think of the law courts, where rulings represent not rubber-stamped social conventions but a process of continuing refinement and modification as the old rulings meet difficulties — the hermeneutic adjustment between the particular and the general. Validity comes from a communality of practice and purposes, not by reference to abstract theory.

Jürgen Habermas {28} also criticizes the rationality of mathematics and science as effectively placing judgement in the hands of specialists, an undemocratic procedure. Man is entitled to his freedoms — from material want, from social exclusion, and from perversions that alienate him from his true nature So his interest in Marxism, not to justify Marxist prophecies, but to rationalize and update Marx's criticisms of societies that force men to act contrary to their better natures. Labour is not simply a component of production, but how men are forced to live.

Mikail Bakhtin stressed the multi-layered nature of language, which he called heteroglossia. Not only are there social dialects, jargons, turns of phrase characteristic of the various professions, industries, commerce, of passing fashions, etc., but also socio-ideological contradictions carried forward from various periods and levels in the past. Language is not a neutral medium that can be simply appropriated by a speaker, but something that comes to us populated with the intentions of others. Every word tastes of the contexts in which it has lived its socially-charged life.

To what extent do speakers really understand each other? Many analytical philosophers would argue that understanding is potentially complete — beliefs, emotions, experiences must be particular to individuals, but statements otherwise can be converted into an objective, literal language, and checked against the facts. Conversely, some literary critics would argue that understanding is an inherently incomplete, or perhaps meaningless term. Interpretative communities have different paradigms or frames of reference, and cannot be compared except to some universal frame of reference, which does not exist.

Bakhtin's work allows us to recognize both views as extreme. There is no purely literal language, and concepts of truth and meaning have finally to be treated as ways of reacting to experience rather than as logical concepts per se. Theorists often overlook the ways we do reach understanding, how we are constantly checking and adapting our paradigms against our understanding of the world. Paradigms that fail to make sense of our surroundings are dropped, or held by very few people. And this, very naturally, is how communities evolve, even the business community. There exists no centralizing programme or policy, but only a network of alliances, overlapping and shifting frames of reference which are constantly being modified — by chance, ignorance, experiences, conversations, by television, newspapers, magazines and books. {29}

No doubt that seems theoretical and remote from issues with money. But problems with reification, of turning attitudes and processes into 'real things that exist across all possible worlds', as philosophers like to put the matter, crop up in all areas of life. What do psychological tests really measure, for example? Intelligence and personality testing is a billion dollar industry, increasingly used to control admission into colleges and jobs. But does the intelligence quotient objectively exist, independent of our measuring it? Or is IQ only a 'latent variable', something more submerged and all-embracing that is elicited by the tests? Perhaps IQ should be defined operationally: it is simply something that IQ tests measure, nothing more. Or again IQ may be social constructs, something manufactured out of the web of attitudes, classes, ethnicities, experiences and gifts in individuals comprising society. These are not idle questions. Many think psychological testing has been over-promoted, and professional psychologists can each be found espousing other views. {30}

Truth may not be grounded in evidence, therefore, but consensus, making language shared ways in which societies understand themselves. The concept of money, by the intimate role it plays in our lives, necessarily takes on shades of meaning and intention that vary with context and their author's view of its functions.

Science and Its Limitations

Readers surprised to learn that simple terms like money can be questioned by literary theory will be further disturbed by contemporary views on the way our brains may create reality. One such view is metaphor theory, which suggests conventional views of science, philosophy, society and even abstract disciplines like mathematics have a basis in innate human dispositions. If we cannot find an objective meaning for money except as something reflecting and facilitating transactions in human societies, when those societies themselves evade full capture by rational processes, the reason may lie in outmoded concepts of certainty. The world is inherently ambiguous, and what seems but plain facts to one generation may be arrant nonsense to the next. Always there is a need for evidence, and close argumentation, but nothing in the humanities or sciences is ever permanently settled, any more than widely differing political views can be finally reconciled, or a definitive account be written of some period in history. We select and abstract the evidence in ways that seems important; we assemble that material in the patterns and pictures we are comfortable with; we find comfortable largely what our backgrounds, experience and personalities dictate; those individual aspects must conform in many ways to the societies in which we live, and those societies are in turn influenced by us. In such complex and interlocking situations, all that we can make of viewpoints are partial and transitory models that correspond to innate bodily processes — models are what metaphor theory calls schemas.

Metaphor commonly means saying one thing while intending another, making implicit comparisons between things linked by a common feature. Scientists, logicians and lawyers prefer to stress the literal meaning of words, regarding metaphor as picturesque ornament. But there is the obvious fact that language is built of dead metaphors. Metaphors are therefore active in understanding. We use metaphors to group areas of experience (life is a journey), to orientate ourselves (my consciousness was raised), to convey expression through the senses (his eyes were glued to the screen), to describe learning (it had a germ of truth in it), etc. Even ideas are commonly pictured as objects (the idea had been around for a while), as containers (I didn't get anything out of that ) or as things to be transferred (he got the idea across).

Metaphor is a commonplace in literature, and generally regarded as a rhetorical device, simply a means of persuasion. {31} Metaphor has only a supporting role in meaning, and certainly not seen as something actually constituting meaning. Yet such is the suggestion of Lakoff and Johnson. {32-33} Metaphors reflect schemas, which are constructions of reality using the assimilation and association of sensorimotor processes to anticipate actions in the world. Schemas are plural, interconnecting in our minds to represent how we perceive, act, react and consider. Far from being mere matters of style, metaphors organize our experience, creating realities that guide our futures and reinforce interpretations. Truth is therefore truth relative to some understanding, and that understanding involves categories that emerge from our interaction with experience. Schemas are neither fixed nor uniform, but cognitive models of bodily activities prior to producing language. The cognitive models proposed by the later work of Lakoff and Johnson are tentative but very varied, the most complex being radial with multiple schema linked to a common centre. Language is characterized by symbolic models (with generative grammar an overlying, subsequent addition) and operates through propositional, image schematic, metaphoric and metonymic models. Properties are matters of relationships and prototypes. Meaning arises through embodiment in schemas. Schemas can also be regarded as containers-part-whole, link, centre-periphery, source-path-goal, up-down, front-back.

The approach is clearly technical and controversial. It contests the claims of philosophy or mathematics to pre-eminence, and places knowledge in a wider context. Meaning lies in body physiology and social activity as well as cerebral functioning. Our temperaments and experiences colour our thoughts, and the philosopher's search for abstract and indisputable truth is an impossible dream. How human beings act in practice is the crucial test, and in practice humans paraphrase according to context and need. Comprehension can never be complete, and specializations that would base truth on logic, mathematics, invariant relationships in the physical world or in social generalities make that comprehension even less attainable. Indeed the approach is entirely misconceived. Multiplicity is what makes us human, and we live variously in conceptions that arise from the totality of our experiences — physiological and mental, private and social. In contrast, economics has imitated science in looking for invariant underlying rules, often cooking the books to do so, but has neglected the completeness of experience. Science and the arts are slowly, very slowly, converging to give us a fuller and more comprehensive view of the world, and that view is anticipated by schema that draw no sharp line between rationality and irrationality, between thought and emotion, between the world out there and our private universes, between our mental and our bodily activities. Yes, the distinctions can be made — and indeed have to be made for practical purposes — but the distinctions represent a narrowing of conception and possibility.

That meanings lie in the social purposes of words rather than any fiat of economists or logicians was the view of the later Wittgenstein, a proposal that has wide acceptance. {34-35} If language is not a self-sufficient system of signs without outside reference, nor a set of logical structures, what else could it be? Social expression. Rather than pluck theories from the air, or demand of language an impossibly logical consistency, we should study language as it is actually used. Much that is dear to the philosopher's heart has to be given up - exact definitions of meaning and truth, for example, and large parts of metaphysics altogether. And far from analysing thought and its consequences, philosophy must now merely describe it. But the gain is the roles words are observed to play: subtle, not to be pinned down or rigidly elaborated. Games, for example, do not possess one common feature, but only a plexus of overlapping similarities. To see through the bewitchment of language is the task of philosophy.

Science itself recognizes the shortcomings in the old attitudes. The descriptive sciences never fitted the formula well, and the social sciences failed altogether. Many complex situations defy mathematically modelling, and are best approached through successive approximation or neural nets. Chaos theory destroys determinism in many areas, emphasizing the importance of the contingent and unforeseen. {36} Economics, when not simply descriptive (i.e. adopting multicentric organizational approaches), has constructed models that are not only over-simple and remote from reality, but intellectually flawed. Worse, according to metaphor theory, economics holds notions of money that are plainly at odds with a just and sustainable society, and should therefore never be alone in the driving seat. Indeed, far from being the truth, as the 'ineluctable hard facts of the market', which have to be followed regardless, allowing only some palliative measures to keep the marginalized and impoverished masses from open revolt, market economics is no more than the special pleading of a business class that naturally wishes to maintain the status quo. Coinage gives tangible reality to authority, but that authority is only how men have traditionally chosen to live together: customs, which we can change, and will have to change if we are to survive on this small planet.

Confidence

Historically, coins rarely contained their full face value of metal, making them to some extent a fiat currency, and one that rulers could exploit by adding base metal to the silver or gold content. Provided government remained strong, the coins were generally acceptable. The coinage of Imperial Roman was consistently debased but occasioned no riots. Intrinsic value was even less a concern in Anglo-Saxon pennies, and issues of Edward the Confessor (1042-66), for example, vary in average weight between 17 and 27 grains. {37}

Money in modern times is overwhelmingly a fiat currency, where confidence is all. Despite assurances, loans were never fully backed by gold, even in the nineteenth century. To be able to 'see the money' gave confidence, but Britain also led the gold standard by reason of a worldwide confidence in its industry, its military strength, and probity of its institutions. Long and stable government gave everyone a faith in the system, and that trust still underpins the financial institutions. Here lies the reason why the banks were bailed out in 2008, and not the innocent parties, though the terms probably guarantee another crash. Sound money is needed by all regimes, and counterfeiting carries heavy penalties: it is not simply unethical but suborns the integrity of the state.

States are self-sufficient entities that today use the media, educational and other institutions to promote an image of authority and civic virtue. In the past, that image was also promoted by coinage, which was persuasive by virtue of its design, workmanship and precious metal content. Even through the appalling carnage of the Thirty Year's War, the parties to the conflict still turned out a competent coinage, in some instances very beautiful coins indeed. Song bureaucracy ensured that China remained a functioning state until the very last years of its ferocious struggle with the Mongols, when its paper currency also collapsed because frantically over-issued to meet the war effort. The Treaty of Versailles made the Weimar Republic an unreal entity, one that clearly didn't own anything, and which was therefore susceptible to hyperinflation.

States are self-sufficient entities that today use the media, educational and other institutions to promote an image of authority and civic virtue. In the past, that image was also promoted by coinage, which was persuasive by virtue of its design, workmanship and precious metal content. Even through the appalling carnage of the Thirty Year's War, the parties to the conflict still turned out a competent coinage, in some instances very beautiful coins indeed. Song bureaucracy ensured that China remained a functioning state until the very last years of its ferocious struggle with the Mongols, when its paper currency also collapsed because frantically over-issued to meet the war effort. The Treaty of Versailles made the Weimar Republic an unreal entity, one that clearly didn't own anything, and which was therefore susceptible to hyperinflation.

Money as a Life Force

In truth, money is far from being an inert accounting device, but something that possesses its own propensities, for good or ill. Nature abhors a vacuum, and so do trade and industry when it comes to stable or predictable currencies. Money can be predatory, and those countries obliged to open their doors to overseas investment when OPEC (or Washington) engineered an oil price hike and set payment in dollars — which has left many perpetually in debt to western interests — had currencies too weak to simply buy dollars on international exchanges. Their modest, self-supporting economic systems did not produce enough in overseas trade to make their currencies attractive to banks and import businesses, and, just as colonial powers introduced currencies in native states by imposing taxation, so by overseas investment the international community drew the smaller countries into its dollar dealings. The result was often to leave them vulnerable to capital flight, and so subservient to western interests. {38}

Currencies often act as states in miniature, jealous and suspicious of each other, allowing no rivals. Disaster has struck those nations presumptuous enough to plan an independent gold dinar: bombings, downed aircraft and regime change. {39} The matter is aired only in the alternative media, no doubt, and Kennedy's assassination seems more likely to have come from attempts to rein in the CIA, than re-issuing silver certificates. {40} BRIC countries have also suffered attacks on their currencies, though attacks were limited by measures the countries took to prevent currency manipulation. China and India indeed enjoyed their greatest GDP growth when they sheltered their currencies from global speculation, and we must also remember that GDP simply measures what is produced in a country, not what remains when profits are returned to investors. {41}

Modern Money Theory

Modern Money Theory (MMT) stresses the obvious, that money should simply enable citizens to work equitably and fruitfully together. Accordingly, it is sovereign governments and not private enterprises that today create money. {42} Money is put into circulation by banks, state and private, and surplus money is drained off by taxation. The two processes ensure that the State will acquire the goods and services it needs to function properly in areas of common good: schools, roads, state security and the like. Paradoxical as it must seem, governments that run balanced budgets therefore harm their economies, since it is only through government deficit spending that wealth ends up in private hands.

We have lived for centuries in societies run on debt, and major changes will be difficult to explain and implement. But MMT points out that the federal tax burden is quite unnecessary, and could be eliminated. The US tax code is a godsend to clever lawyers — an impenetrable 17,000 pages of legalese, where only a third of the taxes raised goes to service government debt: one third is lost in waste and inefficiency, and another third covers tax evasion. {43} Government borrowing is equally unnecessary: it is simply a public subsidy to private investors, though one enshrined by practice from the days of the Bank of England and the National Debt. Nor is there any rationale for private banks charging interest for government loans. {44} Even private and commercial loans need to be rethought. As Keynes put it in his Treatise On Money

'[I]f the banks can create credit, (why) should they refuse any reasonable request for it? And why should they charge a fee for what costs them little or nothing?' {45}

What is needed is a fairer and more efficient system that offers proper incentives, rewarding effort, know-how, co-operation and practical ideas. The argument rests not on ethics but experience.

Matt Ridley's {40} superficial, selective but persuasive defence of free enterprise suggests that the world will go on getting better for everyone. Climate change can be accommodated. Poorer countries have made great strides towards material prosperity in recent decades, and will continue to do so, even in Africa. Much remains to be done — a truly enormous amount — but there is no cause for the pessimism so prevalent today.

Many of the views are contentious — that labourers left the land willingly to escape rural poverty, that threats to species and the environment are exaggerated, that fossil fuels and nuclear power are still the best if not the only power options, that British cotton goods undercut Indian supplies by fair competition, that economic divides are deepening only in the US, that GM crops are beneficial — but the central message is clear. Successful societies exchange products and ideas, learning from each other and mutually improving themselves if not prevented from doing so by church and state (i.e. excessive regulation, patents, etc.) Need is the mother of invention throughout, and innovation comes more from shop-floor pressures than fundamental scientific research. High debt levels, contracting world trade and financial instability will be overcome by ad hoc adjustments just the same, though asset markets, i.e. banks and currency flows, do need to be regulated. In the last 50 years, more people (practically everywhere but not in North Korea, or presumably in the Middle East) have come to enjoy greater choice, greater material prosperity and freedom to go their own way. The world is not about to run out of water, oil or food. There were food shortages that created the unrest of the Arab Spring, certainly, but a contributory factor was foodstuff farming diverted to create biofuels.

Again in the last 50 years, GDP per capita has become lower only in Afghanistan, Haiti, Congo, Liberia, Sierra Leone and Somalia. Life expectancy is lower only in Russia, Swaziland and Zimbabwe. Child mortality has declined. People live longer, and enjoy better health. Living standards fell only in China (1960s) Cambodia (1970s) Ethiopia (1980s) Rwanda (1990s), Congo (2000s) and North Korea throughout. The rich got richer, but the poor did even better (except in the UK and USA). Even those designated poor in the USA generally have electricity, running water, flush toilets, refrigerator, TV, telephone and even a car and air conditioning (the last two in 70% of cases.) Absolute world poverty may well disappear around 2035. Declining inequality stalled in the UK and USA in the 70s, and increased in China and India, but only because the really rich got even more so. Measured in terms of labour needed to produce the item, everything has got cheaper. Competition creates millionaires but also affordable products. Housing is an exception — because of government policies: restricting supply, tax relief on mortgages and preventing property busts. People richer materially are also happier, on balance, but more important is social and political freedom. Of course there are black spots: war, disease, corruption and the continuing post-2008 recession. Debt levels are high, but increased productivity will see them brought down to manageable proportions. The curse of resource-rich countries is not the resources themselves but rule by rent-seeking autocrats. GM crops bring better productivity. {46}

Large companies are commonly inefficient, self-perpetuating and anti-competitive, but not do generally survive for long. Trust, cooperation and specialization (not self-sufficiency) are the key. Agrarian societies spent much of their income on food (e.g. 35% in modern Malawi), which today takes only 14% of the average consumer's take-home pay. And life for modern hunter-gatherers around the world is not idyllic: two thirds of their time is spent under the threat of tribal warfare. 87% experience war annually. Disease, starvation, murder and enslavement are never far away. Homicide rates in Europe fell from a medieval 35% to 3% in 1750 to under 1% in 1950. World population is increasing, but at declining rates: it will probably stabilize at 9.2 billion in 2075, allowing all to be fed, housed and given worthwhile lives. {44}

Rome's energy source was slaves, supplemented by water-power, animals and simple machines. Windmills became important in Europe, and peat fuelled Holland's success. Britain's industrial revolution was made possible by coal and America. The country got sugar from the East Indies, timber from Canada, cotton from the southern American states, and power equivalent of 15 million acres of forest from her coal. However unpleasant the life in industrial cities, it was far worse in the countryside. Birmingham began as a centre of metalworking trade in the early 1600s, helped by being free of a civic charter and restrictive guilds. Success bred success. A disposable income enabled a consumerist society to begin here in the 18th century, well in advance of France and other European countries. American land open to settlers prevented the division of holdings between multiple heirs — the problem in Japan, Ireland, Denmark and later in India and China. Planned parenthood is counter-productive and unnecessary. Mothers automatically limit their families when the child mortality rate declines. They turn to education, improve the lives of their families, follow individual inclinations and take a paying job. Over half the world now has a fertility rate below 2.1, which in some countries now places a strain on loan repayments and pensions. {46}

Ridley's views are not Pollyanna hopes. Mankind now has the technologies to purify saline and contaminated water for US 0.2 cent/litre, to generate biofuels from algae, to make alternative energy sources competitive with oil, gas and nuclear energy, to grow food more cheaply in 'vertical farms', to replace meat sources by artificial protein growth, and to bring health care to the poorest by mobile phone technology. {47} All that is missing is the political will to abandon ruinous resource wars, and engage in more equitable and fruitful dialogue.

Mankind currently faces many problems: environmental degradation {48}, climate change {49}, looming shortages of land and water {50}, corporate takeover of government {51}, rising levels of global debt {52}, debt peonage {53}, surveillance and erosion of civil liberties {54}, the threat of world war as Russia and China challenge American hegemony {55}.

Nuclear annihilation is the greatest threat, yet warfare is not written into our genes but only a legacy of social attitudes. Organized conflicts go back some 6,000 years, well before the creation of money, but not 300,000 years to the origin of Homo sapiens. For 98% of his time on earth, mankind has lived happily and cooperatively without the need for organised killing, and of the three animal species known to engage in warfare — ants, some species of chimpanzees and man — man is by far the least aggressive. {56}

War will not now benefit anyone, even the victors, because economic treasure and blood will have been diverted to wasteful ends. {57} War creates destructive inflation — as it did in Rome, Song China, Spain, Germany and the USA — which in turn brings a host of social evils, even the wholesale collapse of societies. Steven Pinker's findings in his popular 'The Better Angels of our Nature' {58} are no cause for complacency. The major powers may not now be in open conflict, but they still fund proxy wars in the Middle East and elsewhere, and exert 'soft pressure' on smaller countries to adopt policies that benefit their trans-national corporations. Pinker's tables are suspect, {59} and overlook too many instances of the world coming to within a hair's breadth of nuclear annihilation. {60} On all these matters, money acts not only as a colouring agent tracing out the financial arteries of our interconnected world, but as a power that can subvert even the largest democracies.

By perpetuating the status quo, money enters into the very fabric of our lives — the jobs we choose, whom we marry, the sort of people we become. Because money legitimises — strengthens and justifies — existing social structures, the shaping of the modern world is also money's creation, both in what has been achieved and the threats it faces. Vietnam War debts brought an end to the gold standard, which was replaced by floating currencies — i.e. brought the control that the larger banks and financial institutions exert over all but the largest economies, and possibly even them. Keynesian policies gave way to Neoliberal market-based concepts, and the shorter working week predicted in the seventies has in contrast become longer and harder for all but the rich.

The oil shock ended growth in many third-world countries, and these countries, being obliged to cover increased energy costs, found themselves subject to heavy loan repayments to banks that had simply 'conjured the money out of the air.'

Banking greed led to the 2008 financial crash, recession and to the imposition of austerity policies in Europe and to quantitative easing in the USA. Both favour the already rich, and add to social unrest and inefficiencies. Money has corrupted politics, brazenly so in the USA, but also in most countries: China, Russia, Brazil and Europe. Many scourges of mankind — armament, drug and people smuggling, government corruption in the third world, continued proxy wars — would be eliminated by proper oversight of banks and government, but the Neoliberal 'profit at all cost' remains abundantly alive and well. Money invested, or rather not invested in new technologies, have ensured that we still pollute with coal-fired power stations or threaten the health of future generations with nuclear power. We are still addicted to oil, and so to resource wars in the Middle East, however dressed up in the mainstream media.

The dangerous stand-off between the NATO powers and Russia, and the USA against China, threaten nuclear conflict while the west still has the advantage — Russia and China are developing missile technology against which NATO will have no defence — but the whole planet will suffer immediately afterwards. None of this is sensible: Matt Ridley's account emphasises the need for co-operation at all levels, internally and globally.

Money is therefore not the simple measurement tool of economists. Nor is it restricted to markets. Just as laws and institutions grew up to preserve, protect and extend the tradition, customs and inherent values of societies, so money comes to embody and facilitate social transactions. As such it is always complicit with power, with countries and social classes that have the final say on supply of goods and services. As earlier economists understood, money is part of political economy.

Mercury In the ancient world spoke for business affairs, the messenger of the gods but also the protector of thieves, ever obliging to merchants but also duplicitous, taking on many faces. So is money today. It seems a simple concept, but is not, being created out of nothing by banks and governments. It seems a tangible entity, a clearly stated promissory for wealth, but has rarely been backed by its responsibilities because those responsibilities are continually shifting, particularly in societies subject to the people's vote. Individuals have strict borrowing limits, but not so the world's most powerful economies, which are technically bankrupt, but go on borrowing and spending just the same. Can those debts be indeed corrected with a simple keystroke or must the interest payable eventually overwhelm a country's resources? Expert opinion is divided. Is money created out of money, i.e. the financial services, genuinely productive, moreover, or should it be deducted from GDP as an overhead, when neoliberal policies are rapidly impoverishing us? How we view money determines what we expect it to do.

And how we measure it. Economic textbooks rightly call money a measure of value, and government audits would be impossible without such concepts. But is the value of goods and services to be measured in local currencies or US dollar terms, at published exchange rates or purchasing power, using the published statistics or before corrections that most governments impose on the raw data? Differences can be minimal in contemporary situations, but become increasingly important in historical situations, especially in pre-mercantile societies where duties and status defined individuals more than did monetary worth.

As this book has demonstrated, and this chapter emphasized, money is a social creation, and therefore integrates into that community's social structures. The Romans used the fiction of unaccountable slaves to facilitate their vast financial transactions. The Bourbons used government bonds or juros to raise money for state expenditures. The British created the National Debt. All enabled power to operate at a distance, through a complex web of intermediaries, and those intermediaries, as Georg Simmel detailed, operated through the laws and tacit agreements that make up a functioning state. When the state fails, its monetary system also fails, and we have ruinous hyperinflation. Coinage made shadowy matters more tangible, and that glittering projection of authority has now been taken over by the economics profession and the mainstream press. Marx built his system on ethics, college texts assert, but economies of western nations are built on how markets work, on measured facts. Neither is quite true, of course, but once again it is the smooth talking Mercury, the servant of all masters, that gives citizens the comforting answers they need to get through their busy lives. Stop to question those justifications overmuch, and the economy loses its momentum and self confidence. All governments therefore limit areas of public discourse, previously criminalising it as sedition, nowadays branding it conspiracy and fake news. Truth is relative and conditioned by the historicall context, which histography explores.

Marx may well have been over-simple in seeing money as congealed labour, but the co-operation increasingly needed in today's world requires we stop looking at money as an accounting device and more at how money is earned, distributed and invested for the future. Islamic business practices have long held that view, seeing western economics as an attempt to evade the medieval ban on usury. Far from being inert, money in the Christian west promotes the values, interests, and behaviour of the social elite, destructive though that is to global security. {61}

Sensible and sustained investment is essential, but the overriding challenge is to find better models than doctrinaire capitalism or socialism — without endangering the material creativity of the first or the human values inherent in the second. The besetting sin of both is over-simple conceptions, i.e. that societies should bow to the obvious dictates of the 'market' or the 'people'. In contrast, thinkers on capitalism have stressed the intricate and ever-changing make-up of societies, where power is diffused through interlocking mechanisms of individuals, companies and organs of government, each therefore being given a part to play. For that reason, the most productive systems have been intelligent co-operations between state banks, large companies and well-trained work forces: i.e. the Japanese and German models. Internet technology has the power to make all parties even more well-informed and cooperative, but, whatever is chosen or developed, somewhere in the mix will be the marvellous agency of money. We have used it for four millennia, and will continue to do so while man remains the creature he is.