Volume Two

Modern States

Mixed Economies: China

China (with Lydia in Asia Minor) was the first country to use coins, the first to have paper currency, free banking, and a government monopoly of paper currency, perhaps the first to have a kind of currency board (c.1270), and a pioneer in sophisticated forms of exchange control. There were many dynasties, often of great splendor, and that of the Qing (1644-1912) brought territorial expansion, prestige and renewed power, so successfully that China in the eighteenth century was arguably the most prosperous and best-governed country on earth. All changed in the following century, when land hunger, ethnic divides, western influences and declining markets for its products set in motion the vast civil wars that claimed tens of millions of lives and left the country devastated and open to outside exploitation — Opium Wars (1839-60), Taiping Rebellion (1850-64) and Boxer Rebellion (1899-1901). {1}

The country, declared a republic in 1912, was split between contending warlords in the 1920s, suffered a Japanese invasion in 1931, experienced a savage civil war between the communists and nationalists in the 1930s, and finally found unity under Mao Zedong in 1949, who was no less a dictator than Stalin and whose experiments (the Great Leap Forward in 1958-61 and the Cultural Revolution of 1966-76) brought suffering and death by starvation to tens of millions. {2}

Recovery

China's recovery began in two stages. The first was the so-called planning period of 1950-78 when the economy was centralized on communist lines: collectives, state-owned industry and central planning. Even with the Great Leap Forward (1958-60), the subsequent famine and the Cultural Revolution (1967-9) the per capita income more than doubled, from $448 in 1950 to $978 in 1978, a reasonable 2.8% per year. Steel output rose from 1 million tons/year in 1975 to 32 million in 1978. Agriculture did better, the agricultural sector of the GDP growing at 4.9% p.a. from 1970 to 1978.

The second stage was implemented in 1978, under Mao's successor, Hua Guofeng, aided by the rehabilitated Deng Xiaoping. Agriculture was further improved: better irrigation, more fertilisers and fast-growing dwarf rice varieties. Through the HRS (household responsibility system) parts of collectives were set aside for private or family cultivation. The TVEs (township and village enterprises) allowed such produce to be sold on the local market. These relaxations led to remarkable growth: the agricultural GDP sector rose 8.8% p.a. between 1978 and 1984. {3}

Four special economic zones were created in 1979, offering regulations, work rules and taxation favourable to foreign investment, especially in manufacturing, assembly and textile industries, and an enthusiastic 'can do' approach. In 1984, these zones were extended to many coastal cities in eastern China. {3}

China's recovery was the most remarkable on record. In three decades the country has become the world's second largest economy. Steel production is 500 million tons/year, several times the total reached by the US or Soviet Union. Education at all levels has expanded; R&D is fully on a par with that of Europe or America, and life expectancy has grown from 41 in the 1930s to 70 in 2000. Growth has averaged 10% p.a., a doubling every 7-8 years and an 18-fold increase in per capita income during a single generation. China has a fifth of the world's population and has lifted several hundred million people out of poverty. {4}

To acquire cheap imports and machinery, the yuan was initially overvalued at 2.8 yuan to the dollar, and until 1984 China ran a negative trade balance with the west. Gradually the old communist guarantee of food and social security was set aside for a capitalist one of opportunity but little safety net. Exports ballooned, aided by a devalued yuan, set at 8.7 to the dollar in 1994, and continually adjusted until settling to 6.4 to the dollar in 2011. Given the low prices possible with cheap labor costs, the US began to run a large trade deficit with China: the figures are $50 bn in 1997, $124 bn in 2003 and $234 bn in 2006. {5}

The yuan is tightly controlled. Chinese exporters earning foreign currency must convert all proceeds to yuan at rates set by the People's Bank of China (PBOC). Conversely, Chinese companies buying supplies or machinery in foreign currency will get those currencies from the PBOC at the set rate. Two problems arose. {6}

Firstly the PBOC had to print yuan to cover those currency accumulations, which grew to be very large: around $2.85 trillion in 2011, with $50 bn of that in US government obligations. Though controlled, the yuan was in fact tied to the inflationary US dollar.

Secondly, the Chinese government wanted safe investment for its trade surpluses, and preferentially chose US Treasury bills.

As a result, China needs the US as much as America needs China, and both face serious employment problems as their trade declines. US attempts to 'get tough with China' are muted by its immense holding in US dollars, its influence over Iran from which its buys petroleum, and its control of North Korea, which survives as a Chinese satellite.

Inward Investment

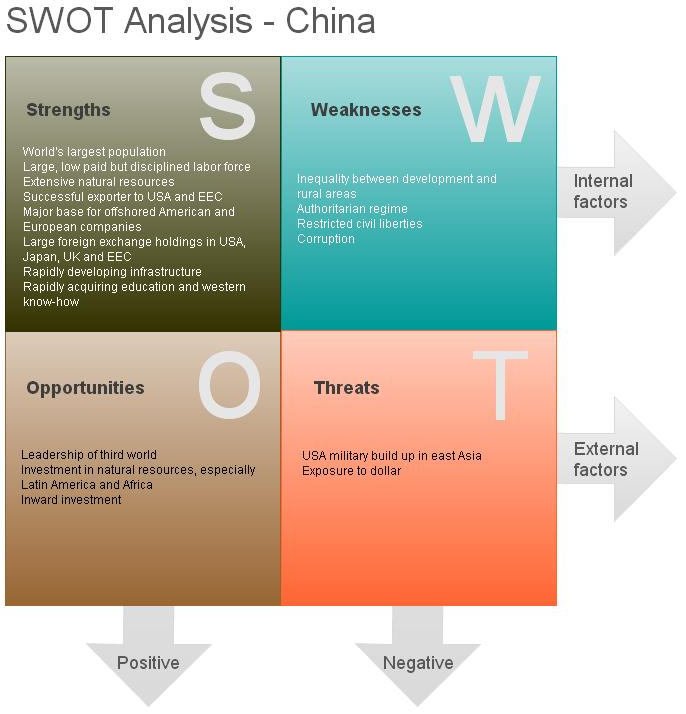

Mindful of China's history, the overriding fear of the current leadership is social unrest. Millions every year leave the impoverished countryside to find work in the new cities and industries, making employment an ever-pressing concern, and western ideas of democracy unhelpful at best, if not subversive. Demonstrations are closed down promptly, and western influences (media and Internet), like the workforce, strictly controlled.

When recession in Europe and the United States reduced its export market, China turned to inward investment, pumping billions into cities, infrastructure and natural resources. The urban population increased by 300 million in 30 years. Exports shifted from primary goods (oil and agricultural products) to labour-intensive products (textile and clothing), then to capital-intensive products (steel, machinery and automobiles) and finally to technology-intensive products (high-tech equipment, software and green technology). Investment and internal markets remain tightly regulated, however, and no doubt use industrial networks and other Internet-based methods of harnessing supply and demand to ambitious growth plans: a considerable advantage over the earlier and wasteful Soviet centrally-planned economies. {7}

As domestic wages began to rise, direct foreign investment began to consider domestic markets. In 2004, the secondary sector's share of foreign direct investment stood at 71%, compared with 23% for the tertiary sector. By 2008, the tertiary sector accounted for more than the secondary. The sums are large, moreover: Chongqing alone attracted an estimated US$10.8 bn in 2011. The Chinese increasingly expect more from life: medium real wage have increased at 17% p.a. since 2009, and workers now take home nearly five times what they did in 2000. {8}

Though China could possibly fund development through its trading surplus, currently exceeding US$ 3 tn, it needs foreign expertise. Thousands of its brightest students are sent to study abroad every year, and its own universities and industrial parks now meet international standards. But practical know-how is paramount, and China aims to learn from the west, not being over-scrupulous about patent and intellectual property laws in developing its own systems. {9}

The global slowdown has hurt this model, and real-estate development (accounting for over 10% of GDP), fell by 16.3% year in the first half of 2012. The knock-on effect in construction materials, furniture, and appliances caused annual growth in fixed-asset investment to fall from 25.6% to 20.4%. {10}

US Rivalry

An undeclared currency war now exists between the US, China and the EEC, which only adds to global instability. {11}

In January 2010, for example, President Obama proposed a doubling of exports, which were causing a -3% drag on the American economy but a +3.5% boost to the Chinese GDP. Consumption was to increase in China, where it accounts for only 38% of GDP, in contrast to 70% in the USA. When that appeal met only a token response, America resorted to quantitative easing (printing money). Such open market operations increased the cost structure of every major exporting nation. The inflation exported to China amounted to 9% in January 2011, an unwelcome development as inflation had been one of the catalysts of the 1989 Tianamen Square protests. Many essential commodities are also priced in dollars, and the rise in foodstuffs precipitated riots in Egypt, Jordan, Yemen, Morocco and Libya, leading to the 'Arab Spring' and the overturning of governments friendly to the USA. Inflation also spread to the euro-zone countries, which were understandably uncooperative at the Seoul G20 summit. {12}

In March 2011 came the Japanese earthquake, and the yen surged further against the dollar in anticipation of massive repatriation of funds for reconstruction. Japan held $2 tn of assets outside the country, of which $850 mn were in dollars. Happily, the G7 countries moved to devalue the yen by massive sell-offs on March 18th 2011, and some of American inflation was undone. {12}

China now holds $1.7 tn of US debt. By a complex web of bank loans (in both directions) America's trade fortunes are tied to the EEC, and vice versa. China has indeed been asked to bail out insolvent members of the euro-zone, and there are moves to limit Chinese influence and encircle the country with US military bases. China has not retaliated yet by selling its dollar holdings en masse and destabilizing its opponent because the cost of doing so would be too high. Although the immediate sale of $1 tn holdings would cause the dollar to collapse on foreign exchange markets, mortgage costs to skyrocket and US property prices to fall, China would lose an essential export market. Nonetheless, the country could avoid economic suicide by slowly shifting its mix of US Treasury purchases, replacing the long term maturities by 3 month maturities. China could also change its foreign currency holdings from dollars to yen, euros and sterling. {13}

Outbound Investment

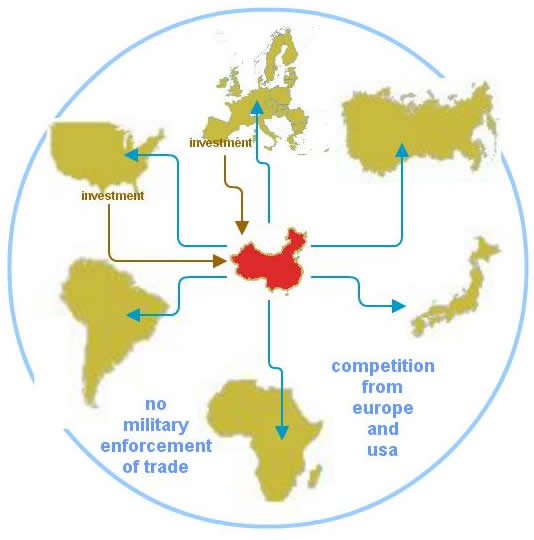

Indeed it is already doing so, but since these are insufficient to meet its needs, China is buying commodities: mines and metal producers, water rights, land to grow foodstuffs in Patagonia, etc. China has greatly increased its gold holdings. Russia and China are in talks to price oil and gas in currencies other than the dollar. China and Argentina have agreed a currency swap of yuan and peso in place of the dollar, and something similar has been agreed with Brazil. The IMF has called for greater use of SDR (Special Drawing Rights: effectively a basket of currencies under its supervision). A report by the Rhodium Group suggested that Chinese outbound FDI could reach $2 trillion by 2020, with Europe being the favoured destination. {14}

Chinese investment in large-scale engineering and construction ( 2005-10): {15}

Area | Investment (US$ bn) | | Sector | Investment (US$ bn) |

Latin America & Canada | 61.7 | | Agriculture | 3.4 |

West Asia | 45.2 | | Energy & Power | 102.2 |

Africa | 43.7 | | Finance & Real Estate | 39.2 |

Middle East | 37.1 | | Metals | 60.8 |

Europe | 34.8 | | Technology | 1.5 |

Australia | 34.0 | | Transport | 7.3 |

East Asia | 31.6 | | Others | 1.1 |

USA | 28.1 | | | |

China's overseas investment resembles the colonial model, but lacks one essential element: military force. Development is being watched carefully, but far from being in a controlling position, China faces competition from Europe and elsewhere. Indeed, since the US runs a large deficit, China's own dollar holdings are helping to fund a military threat to itself. {16}

Outlook

China is following the Japanese nineteenth century model in obtaining western know-how and technological development. Trade surpluses are being invested abroad to prevent yuan inflation and to invite western development. Barring social upheaval, China will become the foremost economic power within a decade or so, and increasingly set the global agenda. {17}

China has a long history, and is picking what it needs from outside models. It has learned from Singapore's experience in building a modern 'Chinese' city with foreign investment, from Japan's neo-Confucian 'industry policy' methods and disregard of Western financial disciplines, from the Nationalist Party's cultural alternative to Mao's communism and from Taiwan's adoption of some US manufacturing techniques. Its tussle with a US hegemony seen by Americans as fairly won by honesty, hard work and international beneficence but very differently by the Chinese, is unlikely to be confrontational unless provoked: by NATO meddling in its western neighbour's affairs, or a needless build up of US bases and fleets in its offshore waters. Similarly, China holds too much of its savings in US treasury bills to instigate a run on the dollar, and will no doubt infiltrate world trade as debt, militarism and political conformity have taken over US governance — by stages, quietly and by outward adherence to existing institutions. Increased democracy is inevitable as economic expectations rise and the better-off return from overseas tours, but the western notion of 'one man one vote' is only one possibility to be drawn from its diverse social history. China has been both innovative and outward-looking (Han and Yuan dynasties) and morbidly xenophobic (Ming dynasty and communist period), depending on perceived threats to its existence, and a more cooperative approach by the west would be in everyone's interests, though hard to achieve in the current standoff. {18}

Many also doubt that China's current growth is sustainable. Collectivisation allowed a country with 22% of the world's population feed itself on only 7% of the world's arable land, but lives were uniformly hard. Nonetheless the 'clay rice bowl' rural policy guaranteed user's rights to the land, and lifetime jobs and benefits were similarly guaranteed to workers in state enterprises. These have been reduced or removed under Neoliberal policies. China now has its millionaires (250,000 in 2005, premier Wen Jiabao's family alone having a wealth estimated at $4.3 billion), but petitions, demonstrations, strikes and riots are everyday occurrences (280,000 incidents were reported in 2010), usually over environmental issues and land confiscation. Lung cancer has increased 60% over the last decade. 70% of China's rivers and lakes are severely polluted. Corruption is endemic: more than 90% of the richest 20,000 are believed to be related to senior government or communist party officials. Vast new building estates stand empty, and highways are built to nowhere. In other areas an austerity programme reigns: consumption, government investment and spending on education have all fallen sharply since 2002. The Chinese stock markets are particularly unstable, expanding 130% over the 2014-5 period, and then contracting 50% in the year following, but the country is an increasingly important player in global finance. {19}

China weathered the 2008 financial crisis remarkably well, but the country is still closely tied to the offshoring needs of multinational companies. In 2009 the $500 iPhone, for example, cost $179 to assemble in China, but only $6.50 were labour costs, the remaining $172.50 being the costs of parts produced in other countries. Work is typically sub-contracted but any attempt at wage rises would see the multinationals move to cheaper countries: to Vietnam, Indonesia, etc. Assembly workers are generally migrant labour returning to the countryside after a few years — often indeed within the year, such is the monotonous nature of work, the cramped accommodation and the poor food. Wages are typically 65 cents/hour (52 cents after cost of food is deducted) for an obligatory 83-97 hour week. Accidents are common: 368,383 serious work-related accidents were reported in 2010, of which 79,552 were fatal. No doubt a more independent or even autarkic Chinese economy could be developed, but only with the threat of social unrest, which China is presently unwilling to risk. {20}

Other Countries: Brazil

Other countries emerging from centralised economies have similar mixtures of political control and market freedoms. In Brazil, for example, the Plano Real, instituted in 1994, pegged the currency (real) to the dollar and brought inflation under control. Government deficits remained in the 6-7% range throughout the 1990s, however, and the real was overvalued, hurting exports. As a spill-over from the Asia crisis, capital that had flooded into the country under liberalization measures took flight, investment falling from US$31.2 bn to US$4.9 bn between 1996 and 1998. The result was a deep recession. GDP growth in Latin America as a whole was 5.3% in 1997, but fell 2.3% in 1998 and then to 0.3% in 1999. Over US$10 bn in rescue loans were provided by multilateral banks, but raised external debt. In 1999 Brazil owed $244 bn or 46% of GDP to foreign creditors. The currency had been set to a crawling peg, which allowed the currency to depreciate at a controlled rate against the dollar, and in early January 1998 the IMF provided a $41.5 bn loan to help Brazil defend its currency when it decided to improve its export position by devaluing its currency by 8%. The move panicked investors, however, and the real had depreciated 66% against the US dollar by the month's end. {21}

The depreciation made payment of Brazil's debt more difficult, but did allow its trading position to improve. GDP growth increased from 0.8% in 1999 to 4.3% in 2000, but worries over Argentina and the leftist credentials of the presidential candidate triggered a confidence crisis. Luis Inácio Lula da Silva won the election, proved not so radical after all, and the economy began to grow more rapidly: 5.7% in 2004, 3.2% in 2005, 4.0% in 2006, 6.1% in 2007 and 5.1% in 2008. The global slowdown struck Brazil in 2009, but GDP growth recovered a year later to reach 7.5% in 2010. Efforts to curb rising inflation, and the deteriorating international economic situation, slowed growth to 2.7% in 2011, and 1.5% in 2012, but Brazil overtook the UK as the world's seventh largest economy by GDP in 2011.

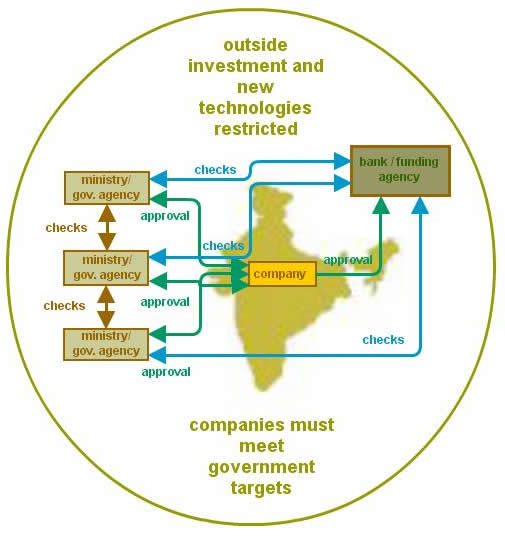

Other Countries: India

India under Nehru focused on heavy industry, at the expense of agriculture reform and export industries. Import substitution was stressed, and licenses placed under state control. Indira Gandhi revived agriculture but further tightened state control over every aspect of the economy. Banks were nationalized, trades were restricted, price controls were forced on variety of products and foreign investment was reduced. The Foreign Exchange and Regulation Act of 1973 shut out foreign technology during much of the 70s and 80s.

Deregulation started in early 1980s and accelerated in the 1990s. Trade, financial and industrial policies were liberalized, and subsidies, tax concessions and export incentives offered through currency depreciation. GDP that had been around 3.5% in the 1970s grew to over 5% in the 80s, but restrictions and the tariffs continued to be among the highest in the world. {22}

India complied with many reforms required by IMF in 1991, but trade union power and subsidies remained 'uncorrected'. But subsidies to farmers are low by international standards. India pays an average of $873 per farmer, compared to $7,860 in the US and $14,136 in Japan. The country is indeed becoming the subject of a bold expewriment, to shift millions from the land to service industries, though where those jobs will come from is less clear.. A 2016 UN report suggested that Delhi's population in 2030 could well be 37 million, offering opportunities to large supermarkets and agricultural companies. {22}

Making India 'business friendly' has already come at great cost to its rural poor.. Besides the usual requirements — allow free entry to capital, reform banks, tax and investment legislation, slim down the public service, cut social welfare and infrastructure projects, and sell off the more profitable public enterprises to large, often foreign companies — the IMF recommended abolishing the minimum wage, which was already low, effectively US 10-15 cents/day on farms though higher in factories and industrial concerns. Large companies like Bata were enabled to replace their payroll workers on US$3/day with independent cobblers on $1/day, a pattern repeated in the jute, small engineering and garments industries. Public servants and private sector workers were laid off, some 4-8 million in a workforce of 26 million, and trade union resistance appreciably weakened. {23}

Destitution was particularly acute in rural areas and some hundreds of thousands of farmers and local craftsmen have either starved to death or committed suicide to escape the onerous loans they had been compelled to take out. Genetically modified cotton has become a further burden, being more vulnerable to water shortages, and requiring costly pesticides and the repurchase of stocks as the seeds lose their vigour after one generation. Large businesses eventually prospered under open markets, but with a net flow of assets from the impoverished to the more comfortably off as foodstuffs and manufactures were diverted from local consumption to overseas markets. With social distress and polarization has come unrest and religious fundamentalism, unwelcome in a political system still notably corrupt. {23}