Volume Two

Modern States

Mercantile Empires

Industrial Britain

Among the European nations, Britain is closest to the United States in its militarism, foreign policy, financial institutions and business attitudes — not simply by virtue of a common language that serves as a bridge for American investment in Europe, but through a shared history.

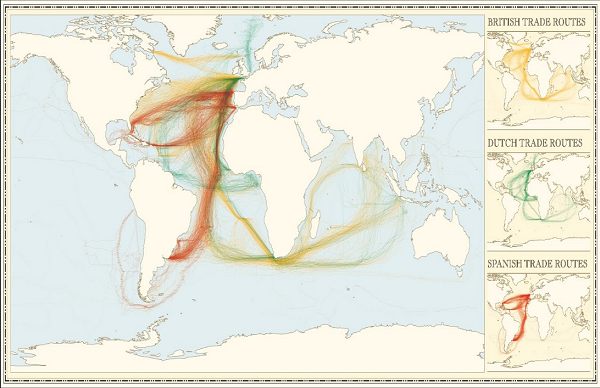

Britain began the Industrial Revolution, and dominated the world economy during most of the 19th century in the way American has since. Britain was a major innovator in machinery, railways, steamships, textile equipment, and tool-making equipment, inventing the railway system and producing much of the equipment used by other countries. It also led in international and domestic banking, entrepreneurship, and trade, accumulating a world empire in the course of its century-long rivalry with France. Originally protectionist, Britain practiced 'free trade', with no tariffs or quotas or restrictions after 1840. Between 1870 and 1900, the GDP per capita rose 500 per cent, generating a significant rise in living standards. Thereafter the country was gradually overtaken by the USA and Germany. GDP per capita in 1870 was the second highest in the world (after Australia). By 1914, it was fourth highest. {1-7} In 1950, British output per head was still 30% ahead of the six founder members of the EEC, but by 2000 it had fallen behind the USA, many European countries and several in Asia. {7}

18th and 19th Century Britain

Land enclosures and then the Industrial Revolution changed the face of Britain, creating the patterns of town, land use and class divisions that still characterize the country. Agriculture was of first importance in the 18th century, and farmers sought to increase yields by making farms sufficiently large to benefit from new approaches, notably deeper ploughing and seed-drills. Similar improvements were made to the rearing of animals, and indeed the two were interlinked in a mixed farming economy where grass and root crops were grown to feed cattle, and their manures were used to fertilize the fields. Production improved in the larger farms, but at the expense of the old social order. Common lands were enclosed, denying the poor the traditional pastures and woodlands needed to tide them over in times of hardship. Tenant farmers who had their rents raised 4- to 10-fold had no option but to move on. Small holders fared no better, and between 1740 and 1788 the number of separate farms fell by 40,000. The pace of enclosure slowly increased. There were 15 enclosure acts between 1728 and 1760, but 1,727 between 1797 and 1820. More than 4 million acres were enclosed by such legislation, and many were forced sales. A few sellers set up new businesses, but the sums received generally only allowed sellers to become waged labourers or work in the new industrial towns. Cottagers, who held their properties by custom rather than legal writ, fared worst of all: there was no compensation for their eviction. The economic changes were threefold. The land was made more productive. A 'reserve army' of wage earners appeared. And an internal market for British manufactures was created among those lifted from subsistence farming . {8}

Coal came to replace wood and charcoal as British forests were progressively stripped and not replaced. Coal production rose from 2.6 m. tons in 1700 to 10 m. tons in 1795. When the coke-smelting of iron ore became a technical possibility, the way was open to large-scale iron production. The 17,350 tons of pig iron output in 1740 had risen to 125,079 tons by 1796. The first iron bridge was built in 1779, and the first iron ship in 1790. Better quality iron, and the invention of the lathe with slide rest and planer facilitated the construction of elaborate machinery. Because transportation costs were high on British roads, canals were built across the country, conveying wheat, coal, pottery and iron goods to the midland ports, and coal to all parts of the country. Roads improved during the 19th century, but railways that became the preferred means of transport for raw materials entering factories and for manufactures being exported to the country at large and thence overseas. {8}

Weaving inventions increased the quality of woollen goods, but it was the embargo on cheap and attractive Indian textiles that stimulated the multiple cotton spinning and weaving inventions making Lancashire a world leader in cotton exports. When the mills became steam-driven, and no longer dependent on river location, new mills and town sprung up across the country. Predominately, the work force was children, often of Welsh, Scottish and Irish parents impoverished by land enclosures, the elimination of cottage industries and rural depression. Though the Poor Rate, which had stood at sterling 700,000 per annum in the mid 18th century rose to sterling 7 million towards its close, it was not sufficient to cover high wheat prices, and there were bread riots throughout the country. The Speenhamland Act of 1795, which sought to base wage assistance on the cost of living had the perverse effect of raising the cost of poor relief, and so bankrupting the smaller farmers who had provided fair wages to the rural poor, requiring them in turn to accept whatever was offered by the larger estates. Children's employment in mills and factories became a necessary income to poor families, and the population increased. Bad harvests from 1789 to 1802 increased the misery, and the British establishment faced ideas perilous to the social order from Republican and then Napoleonic France. {8}

Jacobin ideas of liberty, equality and fraternity were directed against the aristocracy in France, but the target in Britain was the bourgeoisie, who faced demands for universal suffrage and annual parliaments. Though agitation was ill-coordinated and easily suppressed, Pitt suspended habeas corpus in 1794, and enacted laws restricting public meetings. Tom Paine fled to France. Nonetheless, the country was terrorized by strikes, bread riots and machine wrecking, and had to be closely garrisoned with troops, which became an army of occupation in industrial areas. Many looked across the Channel, where Napoleon's genius for rapid deployment on selective targets were outdistancing the old methods of warfare. {8}

But such wars were ruinously expensive to all parties. British costs (sterling 50 million subsidies to European powers prepared to raise armies against Napoleon) were met by taxation on necessities and a large National Debt. A labourer earning 10s a week could expect to pay half that on indirect taxes. Government revenues increased from sterling 18.8 m./year in 1792 to sterling 571.9 m/year in 1815. Interest on the National Debt rose from sterling 9.5 m to sterling 30.5 m. over the same period, and indeed over Pitt's administration another sterling 334 m. was added to the National Debt. To support such measures, banking and credit facilities had to be improved, and some hundreds of financiers admitted to the Peerage. Yet the war often went badly for Britain. Defence of British landowning interests in the West Indies cost 80,000 lives, and a threatened uprising in Ireland led by Wolfe Tone was only averted by force of arms and appeal to the Irish middle and upper classes. {8}

Napoleon also had his troubles. Populaces that had enthusiastically welcomed French forces liberating them from the old regime were less happy with heavy taxes and conscription into seemingly unending wars. Napoleon instituted a ban on British goods, but was met with a more effective blockage by the British navy. Sir Arthur Wellesley coordinated resistance in Spain and Portugal, and his irregular warfare tactics became unstoppable when Napoleon withdrew troops for his disastrous Russian campaign. After defeat at Leipzig, Napoleon was exiled to the island of Elbe, but returned for a short campaign that ended with the Battle of Waterloo. The Bourbons were restored to the throne, but the Code Napoléon could not be undone, either in France or the German states. Britain, which had entered the war as an agricultural country, emerged as an industrial one with the strong banking facilities needed to become the workshop of the world. Territories acquired from France laid the foundations for an overseas empire. {8}

The 1815 victory at Waterloo, which put an end to the Napoleonic Wars and the threatening experiments of the French Revolution, was followed by a slump. Europe was too impoverished to buy British manufactures. Iron fell from sterling 20 to sterling 8/ton, and 24 out of 34 blast-furnaces in Shropshire had to close. To lay-offs were added 300,000 demobilized soldiers and sailors. Paper money had to stay in place to cover the continuing high taxes, and there were widespread disorders when the Corn Laws kept food prices high. National Debt charges amounted to sterling 30 m. in 1820 in a total revenue of sterling 53 m., and such high taxation and inflation levels delayed economic recovery. Habeas corpus was again suspended in 1817, and public meeting likewise restricted, but agitation continued nonetheless, even after the notorious 'Peterloo massacre' of 1819. The Six Acts rushed through Parliament, which banned public meetings, authorized house searches, and punished sedition with transportation, only drove agitation underground. An 1820-26 industrial recovery absorbed some labour, however, and the decline of small-scale plants before large-scale industry, an uneven decline that lasted to the 1840s, split affected parties into different groups. There were still riots, rick-burnings, organized gangs of poachers and an 1830 'labourers' revolt' against threshing machines, but agitation was not coordinated, and gradually subsided until the trade-union led disturbances of 1871. {8}

Working conditions also improved. From 1800 to 1815, Robert Owens' New Lanark Mills demonstrated that profits were still achievable with working hours as low as ten and a half a day: the secret was larger, more efficient machinery and steam-power in place of water. Laissez faire capitalism became the order of the day, though workers were forbidden to form combinations to improve pay, and the landowners could still prohibit the importation of cheaper foodstuffs. The Factory Acts — bitterly resisted by claims that higher wages would make British exports uncompetitive and so ruin everyone — gradually restricted the ages of the employed and the hours worked. Continual improvements in spinning, weaving and other machinery improved efficiency, though some had contradictory effects. The Davy lamp, introduced to prevent underground gas explosions, encouraged mine-owners to extend workings beyond what was safe. Nonetheless, factory legislation led to machines rather than workers being pushed harder, though the large capital requirements naturally led to closer ties with the financial institutions. {8}

Industrialists could purchase country estates, but were still not accepted into the land-owning aristocracy represented by the backward-looking Tory party. But change did come. A police force made detection rather than savagery of sentence a deterrent. Tariffs were reduced when they interfered with trade. The British Government supported liberation movements in Greece and Latin America. The 1832 Reform Bill swept away rotten boroughs and gave suffrage to house owners and tenant farmers — for all that reform had to be urged on by carefully staged riots. Suffrage increased from 220,000 voters to 14 million, and the Commons gained power at the expense of the Lords. Yet the poor who had fought hardest for reform were not represented at all, and the common people turned from parliamentary hopes to Chartism and revolutionary trade unionism. {8}

Reforms continued under the ascendant Whig parties. In 1834, when relaxation of income tax after the Napoleonic Wars, and the sheer cost of the Speedhamland system, brought many parishes to the brink of bankruptcy, the Poor Law was amended, giving recipients a choice between factory work or the poorhouse. The last were particularly resented — the work was often senseless and degrading, breaking up the family unit — and many indeed were burnt down. But the labour market picked up in the 1830s and 40s when the railway boom needed construction workers, and low transportation costs boosted industry. UK exports rose from sterling 69 m. in 1830 to sterling 197 m. in 1850. Pig iron production rose from 678,000 tons in 1830 to 2.7 m. in 1852. Coal production rose from 10 m. tons in 1800 to 100 m. tons in 1865. All created employment opportunities: on the railways, in coal-mines and factories. Working conditions were ameliorated by the 1847 Factory Act, Coal Mines Act and the Ten Hour Act. Even the Corn Laws were repealed in 1846, free trade being then extended to sugar and timber. {8}

Farming also benefited from investment and innovation. Cheap loans authorized by Parliament allowed farms to modernize. Mechanized pipe-making aided irrigation. Nitrates, guano and bone manure came into common use as fertilizers. The Royal Agricultural Society Show in 1853 exhibited no less than 2,000 implements. Farm wages rose as competition from railways and factories drew men off the land — though they fell again in the 1870s when Australian wool and American wheat came flooding into the country. {8}

Twentieth Century Britain

The twentieth-century economic history of Britain is commonly divided into: {6}

1920s: war debt, deflation and life under the gold standard.

1930s: mass unemployment.

1940-50s: austerity, rationing, war debt, but full employment, new welfare state and rising living standards.

1960s: confidence, prosperity and alternative cultures.

1970s: era of discontent: strikes, 3 day weeks, inflation, boom and bust.

1980s: Thatcher years of monetarism and financial deregulation, two deep recessions, mass unemployment, and then boom.

1990s: recession and then the great stability.

2000s: financial innovation and deregulation, housing boom - leading to bank/building society collapses and government bailouts.

2010s: austerity and recession.

1979-90 Margaret Thatcher Experiment

The Keynesian policies of consensus government assumed a reasonable rate of economic growth, but Britain's economy generally lagged behind those of its European competitors. An obvious problem was a balance of payment deficit, which continually placed sterling under strain. As employment increased, costs and wages rose, and imports were sucked in. Since sterling was an international currency, making devaluation unthinkable, the only recourse was to cut demand. Unemployment rose as a result, and the government subsequently had to raised the level of demand, when the stop-go cycle started all over again. The deeper problems were equally intractable. The UK had kept to its minimal early 19th century model of entrepreneurship, in contrast to a Japanese state-led or European corporatist model. Banks and businesses favoured the short term, promoting accountants and lawyers to their boards rather than engineers or scientists. There was no real power sharing in companies, nor collaboration across class lines. Nor was there a Labour Market Board as in Sweden, or the statutory Works Councils of Germany. UK companies did not treat all workers as members of a community, promote senior employees to the board, put service to their workforce, communities and customers before those to shareholders, or resist the perpetual take-overs that benefited only the shareholders of the company being taken over. No effective remedies were offered by the main political parties. The Labour Party looked to increase state aid, though this resulted in bloated bureaucracies. The Conservatives looked for a change in attitude, but found no underlying morality or community of interests. Companies had ignored Callaghan's 5% norm, as they had Macmillan's 'guiding light'. Thatcherite policies therefore championed the market, though the reasons given were often bogus. The proportion of GDP spent on public services was in fact lower and not higher than the majority of Britain's competitors. State intervention, far from crippling, had in fact been very beneficial in Sweden, France and Japan. Inflation was not necessarily bad for growth. France and Japan had high growth and high inflation. West Germany had high growth and low inflation. America had low growth and low inflation. Britain had low growth and medium-high inflation. {9}

The Conservative government inherited weak management, poor industrial relations, ineffective research and development, and low levels of vocational training. Despite the rhetoric, these remained largely unchanged, though the Thatcher government was successful in meeting its chief aims — to master inflation, reform the trade unions and privatise the state monopolies. The cost — increased unemployment, fractured communities, fraying social cohesion and growing distrust of the political process — was high, and the long-term benefits are still debated. {9-10}

Faced with a large deficit (50 bn sterling in 1993), an ageing population and more single-parent families, the Conservatives carried through a three-phase programme. They restructured the welfare state, reduced public provision in favour of private, and transferred resources from the less to the more well off.

The stated aim was to reduce the public sector borrowing requirement, and to gain votes through tax breaks. Thatcherism was part of an international Neoliberal movement that aimed to increase deregulation and privatisation, phase out government subsidies, reduce high marginal rates of personal tax, free labour markets and reduce collective bargaining, deregulate capital markets and reduce disincentives like social benefits. {9}

Current Picture

Britain slowly adjusted to its loss of empire. {11-15} Services took precedent over manufacturing, and financial services currently employ over a million people, accounting for 9% of UK GDP and 12% of UK tax receipts. Their contribution to GDP (8.8%) is higher than that of other advanced nations (USA 8.4%, Japan 5.8%, Germany 8.3% and France 5.1%). UK fund managers hold sterling 3.2 tn in financial assets. Foreign companies invested sterling 33 bn in the UK financial services sector between 2008 and 2010, more FDI than in any other sector of the economy. Of the 953 foreign companies authorized by the FSA in 2010, 420 were US-owned. {16}

Online transactions more than doubled to nearly 6 billion between 2005 and 2010, but London's GVA (gross value added) in financial & insurance activities fell by 2.2% in 2010, growing by 1.5% in 2011 but expected to grow by only 0.1% in 2012. Though not part of the euro-zone, London's performance is much influenced by the global economy, and financial & insurance activities are indeed forecast to slow to a halt as the euro-one crisis damages investor confidence. The higher liquidity and capital requirements in Basel III, the required separation of retail and investment banking, and the general restructuring of bank operations are further threats. {15-17} The CIA summary gives the salient points:

'The UK, a leading trading power and financial center, is the third largest economy in Europe after Germany and France. Agriculture is intensive, highly mechanized, and efficient by European standards, producing about 60% of food needs with less than 2% of the labor force. The UK has large coal, natural gas, and oil resources, but its oil and natural gas reserves are declining and the UK has been a net importer of energy since 2005. Services, particularly banking, insurance, and business services, are key drivers of British GDP growth. Manufacturing, meanwhile, has declined in importance but still accounts for about 10% of economic output.'

'In 2008, the global financial crisis hit the economy particularly hard, due to the importance of its financial sector. Falling home prices, high consumer debt, and the global economic slowdown compounded Britain's economic problems, pushing the economy into recession in the latter half of 2008 and prompting the then Brown (Labour) government to implement a number of measures to stimulate the economy and stabilize the financial markets. Facing burgeoning public deficits and debt levels, in 2010 the Cameron-led coalition government (between Conservatives and Liberal Democrats) initiated an austerity program, which aimed to lower London's budget deficit from about 11% of GDP in 2010 to nearly 1% by 2015. The Cameron government raised the value added tax from 17.5% to 20% in 2011. It has pledged to reduce the corporation tax rate to 20% by 2015. However, the deficit still remains one of the highest in the G7, standing at 6.0% in 2014.'

'In 2012, weak consumer spending and subdued business investment weighed on the economy, however. In 2013 GDP grew 1.7% and in 2014, 2.6%, accelerating unexpectedly because of greater consumer spending and a recovering housing market. The Bank of England (BoE) implemented an asset purchase program of sterling 375 billion (approximately $586 billion) as of December 2014. During times of economic crisis, the BoE coordinates interest rate moves with the European Central Bank, but Britain remains outside the European Economic and Monetary Union (EMU).'

Britain is not a fully functioning democracy:

'Looking back on the landscape of power which I have surveyed in this book, whether in the regions of government or of business, I find it hard to recognise it as belonging to the British democratic tradition, with its small clusters of self-enclosed, self-serving groups on the peaks, and the populace on the plains below.' {20}

Sampson's detailed survey of Government, the Civil Service, the Legal Profession, Academia, Broadcasting, Newspapers, Corporations, Banks and Financial Institutions found that not only were they unaccountable, very largely, to the groups they purported to serve, pursuing their own agendas, but they were remarkably incompetent. Many institutional heads couldn't do the job, and didn't do the job, and were fired, eventually, with handsome compensation, when someone equally unsuitable took over.

Beneath the announced recovery may indeed lie disturbing trends. Serving oneself and friends rather than the community is widespread, {21} even among MPs, {22} and outsourced torture has been routine but unspoken about for decades. {23} Property prices continue to increase (some 15-20% being bought by buy-to-let landlords), but volumes are down 40% in eight years. Unsecured debt now stands at sterling 10,000 per household, and even a minor increase in interest levels would create mortgage arrears in half a million households. A quarter of the population have nothing put away for a rainy day, and 60% have less than sterling 1,000 in savings. Full time jobs have collapsed in the UK since 2008, and now account for only 1 in 40 of new jobs. MarketWatch and others believe the stock market has only begun its correction, which may well be worse than 2008, pitching into recession an unproductive and unbalanced economy. {24} Perhaps to forestall trouble, Britain's Internet and email surveillance now exceeds that of America's NSA. {25} Tax avoidance by large companies (with apparently government collusion) is an accepted fact of life. {26}

Economic Models

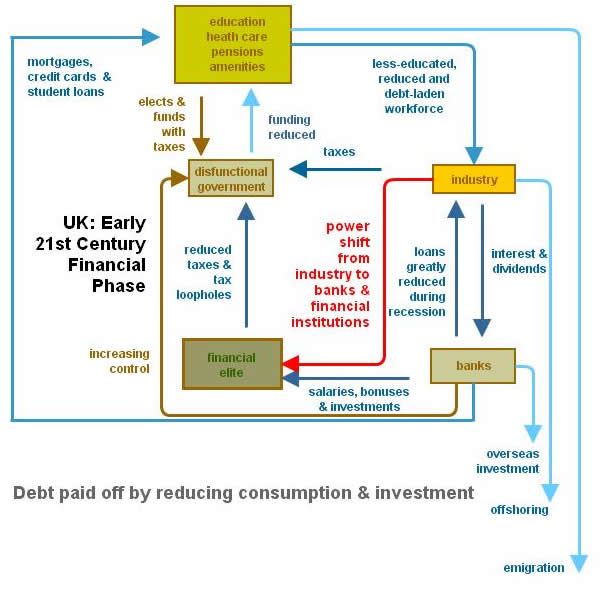

Under its previous coalition and current Conservative government, the UK adopted both the EEC austerity approach and the US preferential treatment of banks.

Michael Hudson's analysis of the US scene {27} therefore applies to the UK, and recognizes a two-century-long industrial phase where governments have taxed the 'unearned' income from land rent and natural resources to provide a higher standard of living to the workforce employed in mines, farms, businesses and industries.

Starting with the Thatcher years, however, the model has been reversed, with the banks and financial institutions gaining the power formerly enjoyed by the landed aristocracy. Failing banks have been bailed out with taxpayers' money (with the government obtaining a voice in their management, however). Public services have been privatised and/or cut back. Debt has been increased by the Bank of England's quantitative easing /printing money, and the orthodox economics appearing in university courses and business magazines has become an instrument of power, making no distinction between productive (investment in industry, innovation and training) and non-productive (capital gains in land prices, stocks and bonds). UK economic performance has been unexciting. {28}

Hudson's forecast is of increased inflation as the financial elite bid up land prices and stocks — coupled with deflation as interest payments reduce expenditure on goods and services. Something similar to Japan's 'lost decade' is possible, and it's worth noting the widespread riots of 2011, {29} and that ten percent of British nationals now live abroad. {30} Civil rights are being further curtailed. {31}

Hudson's forecast is of increased inflation as the financial elite bid up land prices and stocks — coupled with deflation as interest payments reduce expenditure on goods and services. Something similar to Japan's 'lost decade' is possible, and it's worth noting the widespread riots of 2011, {29} and that ten percent of British nationals now live abroad. {30} Civil rights are being further curtailed. {31}

Britain has a diverse and often innovative workforce, {32} but many problems are deep-seated. Organized labour still resents its treatment in the nineteenth century. British industries were slow to modernize because investment went preferentially to colonies, {33} and those overseas investments have been protected by a foreign policy presented {34-35} as enlightened but often colonialist: British governments were complicit with reprehensible events in Indonesia, Kosovo, Iraq, Afghanistan, Kenya and Malaya, {36} helped as always by draconian Official Secrets Acts. {37} Yet even the nineteenth century, as Polanyi emphasized, was anything but simple. {1} The Speenhamland Act of 1795, introduced to supplement land wages and curb the drift to new manufacturing towns, paradoxically demoralized and pauperised the rural communities. A flood of legislation to make factory work safer was not forced through by organized labour in the later nineteenth century but by the factory owners themselves in answer to more egalitarian outlooks. Nonetheless, the governing classes gave up power slowly. Sedition was suppressed {38} and the Chartist agitation for universal suffrage was denied until society had settled into more stable social classes, which on the eve of W.W.I. still had dangerous, anarchic strands. {39} Even the gold standard, which was to operate across political boundaries, had the perverse effect of heightening international rivalry, which increased the scramble for colonies and put an end of the old order with W.W.I. {1}

Prisoner of the Past

Britain is not a modern country like Germany or Italy. Nor was its monarchical structure swept away by republican revolution in the French manner. Class is an ever-present aspect of social life, and when American actors play English roles, for example, they invariably miss the hundred and one distinctions shown by dress, manners, speech and deportment that the English imbibe with their mother's milk. Those distinctions led to gross inequalities in the nineteenth century, and are still remembered. Tony Blair's achievement under New Labour was to encourage the working classes to forget their grievances and benefit from middle class opportunities, but the Tory party under David Cameron has again deepened social divides and created the Brexit vote. Land is the preferred distinction of the socially ambitious, and indeed 50% of rural land is owned by only 0.6% of the population. {4} That land is managed professionally, of course, and no doubt Lord Salisbury's comment that government should not be in the hands of those tempted by greed remains a wise counterweight to thoughtless universal suffrage. {38} But not all those favoured by wealth recognized their social obligations, and a new moneyed class is even less bound by noblesse oblige. With a bob to democracy — the royal family project a middle class life style, and stately homes are thrown open to the public — appearances have been kept up, but at some cost to natural abilities. Investment that went abroad in the twentieth century now goes into financial services, and not generally into projects that could make Britain a more equal, productive and forward-looking country.